Future-Ready Payments.

Real-World Compliance.

CurrenC is a licensed South African Financial Services Provider (Category II with CASP) specialising in the development of stablecoin-powered payment and rewards applications.

Who We Are

CurrenC builds the bridge between traditional banking and the tokenized digital economy.

We design, build, and operate stablecoin-based applications for payments, rewards networks, and treasury operations—allowing our clients to benefit from instant settlement, lower fees, and programmable financial logic, without taking on crypto-integration risk themselves.

Technical Infrastructure

- Stablecoin wallet APIs

- Tokenized rewards engines

- Merchant onboarding & identity verification

- Blockchain transaction management

- Secure custody and permissions frameworks

Compliance Infrastructure

- FAIS-aligned governance

- CASP-aligned risk & controls

- FIC Act compliance

- AML/CTF monitoring

- Real-time transaction reporting

- Audit-ready documentation and controls

What We Do

We deliver the full stack of financial technology and regulatory infrastructure required to operate in the digital asset economy.

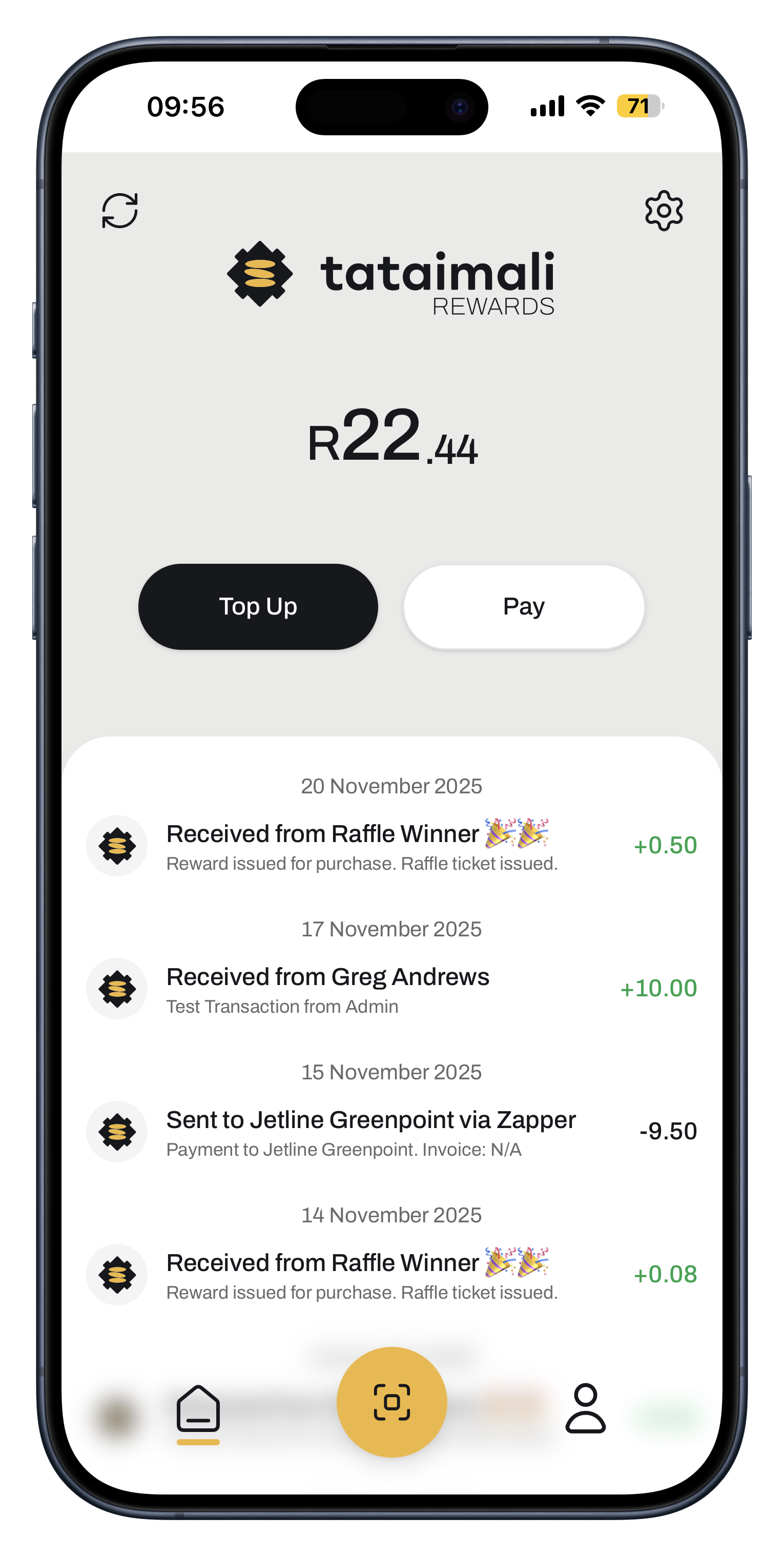

Stablecoin Payment & Rewards Infrastructure (SaaS)

We build white-label payment and rewards platforms using tokenized fiat currencies (e.g., ZAR stablecoins).

- Seamless digital payments

- Merchant-centric rewards

- Real-time settlement

- Cross-platform interoperability

Compliant Stablecoin Treasury & Market-Making

We operate a professional market-making function on licensed South African crypto-asset exchanges using our own investor capital.

- Transparent flow of funds

- Full AML/CTF monitoring

- No exposure to third-party funds

- Verified audit trails

Why Banks Work With Us

Banks are increasingly cautious when dealing with crypto-related businesses. CurrenC is built to meet and exceed those expectations.

Regulated Counterpart

CurrenC is a licensed FSP operating under a FAIS Category II licence with long & short-term deposits and CASP class of business

Full AML / CTF Capabilities

FIC reporting, Risk-based business rules, Transaction monitoring, and Audit-ready compliance registers

Fit-and-Proper Governance

CurrenC is run by FAIS-approved key individuals with established governance, and internal and 3rd party compliance oversight.

Transparent and Well-Controlled Fund Flows

CurrenC can clearly demonstrate source-of-funds, and end-to-end transaction traceability. CurrenC’s reporting, controlled trading environment, and clean, auditable fund flows.

Why Crypto Exchanges Partner With Us

Crypto-asset exchanges require liquidity providers with clean capital, transparent governance, and sophisticated trading expertise.

Transparent Funding

We deploy only our own capital for market-making—no third-party funds, no customer deposits, no custodial risk.

Trading Expertise

Managed by CA(SA) and CFA charterholders with backgrounds in high-frequency systematic trading.

Sophisticated Controls

Segregated treasury accounts, Multi-layer access control, Automated reconciliation, and Independent reporting lines.

Proven Track Record

15+ years of treasury and cross-border payment experience, including building and scaling multinational payment companies.

Why Regulators Can Rely on Us

Regulators expect strong governance, demonstrable competence, and a business model aligned with financial-sector legislation.

Certified Key Individual (FAIS)

Pierre van Helden holds RE1, RE3, and RE5 certifications with deep experience in regulated businesses.

Chartered Accountant (SA) + CFA

Nick Hill brings institutional-grade financial risk, valuation, and control frameworks.

Deep Blockchain Academic Specialization

Strong emphasis on continuous professional development, with leadership currently pursuing postgraduate studies in Blockchain and Digital Assets.

Comprehensive Compliance

Formal ML/TF risk framework, KYC/AML policies, and off-chain/on-chain transaction surveillance.

Our Commitment to Safety

CurrenC’s operational philosophy is built around three core principles.

Regulation First

Compliance is integrated into every product we build and every decision we make. We do not move without regulatory alignment.

Auditability

All flows of funds, both fiat and stablecoin, are fully auditable through banking records, exchange records, blockchain explorers, and reconciliation tools.

Transparency

We maintain open relationships with banks, regulators, exchanges, and clients. Our goal is to lead Africa’s transition to safe, compliant, tokenized payments.

Leadership

Pierre

van Helden

Fintech entrepreneur with 15+ years in FX, payments, treasury, and digital assets. Expert in FAIS compliance, exchange control, blockchain protocols, and real-world tokenization. Currently pursuing a Master’s in Blockchain & Digital Assets (University of Nicosia).

Nick

Hill

CA(SA), CFA, former VP of Systematic Trading at Invictus Alpha and Co-Founder of a global HFT crypto trading desk. Expert in algorithmic trading, risk systems, reconciliation automation, and digital-asset market structure.

Let’s Build the

Future of Rewards.

To explore partnerships, banking integrations, stablecoin rails, or SaaS deployments, talk to the CurrenC team.

Common

Questions

Technical & Regulatory Details

CurrenC is a fully licensed Financial Services Provider (Category II) and operates in strict alignment with the Financial Sector Conduct Authority (FSCA) and emerging Crypto Asset Service Provider (CASP) frameworks in South Africa.

No. CurrenC is an infrastructure provider, not a bank. We do not accept consumer deposits or pool client funds. We operate strictly with our own capital to ensure liquidity and stability, eliminating the risk of run-on-the-bank scenarios.

We provide a white-label, audit-ready SaaS layer that connects traditional banking rails to blockchain networks. This allows institutions to mint, burn, and transfer ZAR-pegged stablecoins with sub-second finality and complete transparency.

Our primary focus is on regulated ZAR-pegged stablecoins for the South African market. We also provide interoperability with major global stablecoins like USDC and EURC to facilitate cross-border settlements.

We operate our own proprietary treasury management strategies across multiple licensed exchanges. This ensures deep liquidity for our partners at all times, managed by a team of experienced chartered accountants and CFA charterholders.